top of page

AltG Investment Research Lab

Investment Research In Practise

India’s Power Grid Is Due for a Redesign — Not Just an Upgrade

India’s power challenge is no longer about adding generation capacity. It is about managing volatility. Like pharma once redesigned its supply chain to distribute risk, the power grid must shift from asset-heavy planning to system-level orchestration.

AltG

Jan 5

Moneyball Strategy: From Baseball to Business

The Moneyball strategy originates from Moneyball , Michael Lewis’s account of how Billy Beane , then General Manager of the Oakland Athletics , rebuilt a competitive baseball team with one of the lowest payrolls in Major League Baseball. When Billy Beane ran the Oakland Athletics , he faced three structural realities: a) Severe Capital Constraint Oakland’s payroll was a fraction of competitors like the Yankees. Competing on “stars” was mathematically impossible. b) A Broken

AltG Investment Research Lab

Dec 29, 2025

Reliance’s ICC Rights Collapse Shows the One Thing Money Can’t Buy: Strategy

Reliance didn’t lose money on cricket because the sport is unprofitable. It lost money because it mistook spending for strategy.

AltG

Dec 8, 2025

India Wants Nifty at 100,000? Here’s the Hard Truth.

The core idea is shifting the focus from defending the rupee (short-term noise) to upgrading India's capital architecture. This systemic change is the "structural force" needed to unlock Nifty 50's potential for 100,000.

AltG Investment Research Lab

Dec 5, 2025

The Rupee’s Slide in 2025: A Crisis, A Signal, and an Opportunity

A weak Rupee was inevitable. A strong Rupee is a choice. India wins when INR assets become world-class, high-value services scale, and capital flows chase Indian growth.

AltG Investment Research Lab

Dec 2, 2025

What’s Slowing Apple India? Apple India.

Apple Inc.’s explosive growth in India, long seen as the company's next frontier, has hit a wall. New filings reveal that annual sales growth has decelerated to 18% year-on-year, the slowest pace in six years. This slowdown signifies the end of the "easy pickings" era, where a low base and strong brand equity drove impressive numbers. Now, analysts warn growth could dip further to the 10-15% range, signaling a critical need for a strategic pivot.

AltG Investment Research Lab

Nov 18, 2025

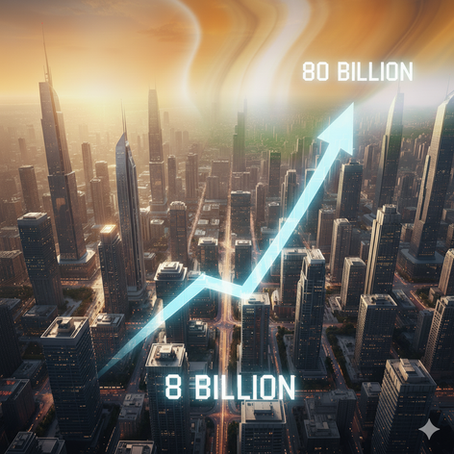

License to Build: Can Godrej Properties Leap From 8 to 80 Billion?

Godrej Properties: The Brand That Sells Fast — But Must Now Deliver Faster For years, Godrej Properties Ltd. (GPL) has been India’s polite powerhouse — a brand everyone trusts, but few associate with breakneck speed. That perception is starting to change. In the September quarter, GPL delivered its highest-ever second-quarter and half-year profits — ₹405 crore and ₹1,005 crore respectively, up 21 % and 18 % year-on-year. Bookings hit ₹8,505 crore , a 64 % jump from last yea

AltG Investment Research Lab

Nov 12, 2025

Can IGI (International Gemological Institute) Polish Itself Into India’s Brightest Diamond?

When the International Gemological Institute (IGI) listed in India earlier this year, it glittered. The stock soared over 50%, marking one of the most successful IPOs in recent Indian market history. Investors loved the story — an asset-light, global certification business positioned at the intersection of luxury, trust, and technology. After successfully navigating tariff wars, the company’s latest earnings confirmed sustained growth, driven by increasing global certificatio

AltG Investment Research Lab

Nov 6, 2025

Hitachi Energy India Gains 13% on Strong Q2 Results: Can the Momentum Continue?

Hitachi Energy India reported a stellar Q2 FY26 with profit up 4× and order inflows rising 13%. As India’s leading power-infrastructure company, it’s now positioned at the intersection of the energy transition and the AI revolution. With a ₹29,000-crore backlog and expanding margins, the company is powering the grids and data-centre infrastructure driving India’s next phase of growth.

AltG Investment Research Lab

Nov 4, 2025

Barbeque Nation: Sizzling or Fizzling?

Barbeque Nation’s stock is down 65%, but India’s dining boom isn’t over. The brand must evolve—asset-light, AI-driven, and health-focused—to reinvent itself for a new generation of diners.

AltG Investment Research Lab

Oct 21, 2025

INDIA AIRPORT PRIVATISATION: THE NEXT FRONTIER OF INFRASTRUCTURE AND AI GROWTH

Indian airports present one of the most compelling infrastructure investment opportunities globally. With one of the fastest-growing economies and an under-penetrated aviation network, India’s “patronage” assets such as airports represent scalable, recurring-revenue platforms that combine infrastructure, real estate, and digital transformation. As policymakers in India accelerate airport modernisation and expand aviation access to Tier-2, 3 and 4 cities, private capital and s

AltG

Oct 18, 2025

Born to Be Wired, Built to Control: John Malone’s Lessons for India’s Founders

Startup founders in India pour their lives into building companies — often ending up with less than 5% ownership by the time the IPO bell...

AltG

Sep 23, 2025

Can Starlink Deliver in India After Tesla Missed the Mark?

The lesson is clear: Starlink’s satellites may be in space, but its success will be decided on the ground

AltG

Sep 10, 2025

Fixed Income Market Infrastructure: The Key to Unlocking India’s Growth

Is India ready to strengthen its credit market infrastructure, build CDS liquidity, and enhance risk pricing for financial stability?

AltG Investment Research Lab

Mar 24, 2025

Can Abenomics-Inspired Strategy Unlock $2 Trillion Boom For India?

How Can India unlock a $2 trillion boom with bold tax reforms and a strategic Abenomics -inspired approach?

AltG Investment Research Lab

Mar 17, 2025

What's the Right Brushstroke for Asian Paints: Acquiring Akzo Nobel India?

What's the Right Brushstroke for Asian Paints: Acquiring Akzo Nobel India?

AltG Investment Research Lab

Feb 20, 2025

Move Over Berkshire, This Is India's Trillion Dollar Investment Opportunity Of The 21st Century

India’s specialty companies represent a goldmine of investment opportunities.

AltG Investment Research Lab

Sep 3, 2024

Why Derivatives and Capital Markets Matter for India's Future?

Why Derivatives and Capital Markets are the most important weapon for India to drive economic growth?

AltG Investment Research Lab

Jul 16, 2024

The Perfect Storm of Private Credit for India: Will it be Rains or Thunder Striking?

Success in India’s private credit market demands deep operational insight and local presence.

AltG Investment Research Lab

Jun 21, 2024

Why India Inc.'s CAPEX Strategy Could Be a Game-Changer?

India Inc.’s CAPEX Dreams: Focus On Returns and Financing Structure, Not Just Expenditure A quick look at the media and pundits shows the...

AltG Investment Research Lab

Jun 19, 2024

bottom of page